bozeman | Business |

You have a lot of options when picking a business entity for your startup. There is no right or wrong choice in this process, only the best one for the goals that you have set for your business endeavor. To help you pick the appropriate structure for your company, we have listed below the most common types of business entities.

1) Sole Proprietorship

A sole proprietorship is the most prevalent type of business organization since it is easy to form and gives you total managerial control. This setup means you are your own business. The most glaring advantage to this is that you have nobody to answer to.

On the flip side, you are also liable for all the financial duties and obligations of the business. This type of setup can also become cumbersome when tax season comes around or when a lawsuit is filed against your business.

2) Partnership

A partnership is a business organization that involves two or more people who decide to share in both the profits and losses of a business. This type of business entity is also fairly easy to operate and forming a partnership would let you raise money by selling partnership interests.

One primary advantage is that the partnership does not carry the tax burden of profits or the advantage of losses. Profits or losses are passed on to partners to report on their individual income tax returns. However, one disadvantage is a liability as each partner is responsible for the financial duties of the business.

3) Corporation

A corporation is a legal entity that is crafted to conduct business. The corporation becomes an entity that is clear from the people who established it. Much like a person, a corporation can be levied with tax and may also be held liable for whatever actions it undertakes. A corporation can also make a profit.

One significant benefit of a corporation is you can elude personal liability. However, one big drawback is the expenses that come with forming a corporation. The extensive record-keeping can also be a drag.

4) Limited Liability Company (LLC)

The limited liability company or LLC is a hybrid form of partnership that gained some momentum over the past few years because of its ability to let owners partake in the benefits of both a partnership and a corporation. The main advantages of this type of business structure are that profits and losses can be passed through to the owners without taxation of the business. Owners are also protected from personal liability.

Picking a Business Entity

When selecting a business entity to form, you have to consider several factors such as:

1. Legal liability

Each of the aforementioned entity types provides a specific degree of protection for their assets from their business endeavors. Sole proprietorships and the general partners of partnerships hold personal liability for the activities of their entities. You need to ask yourself if you can personally afford the risk of potential liability. If you answer no, a sole proprietorship may not be the best option for you.

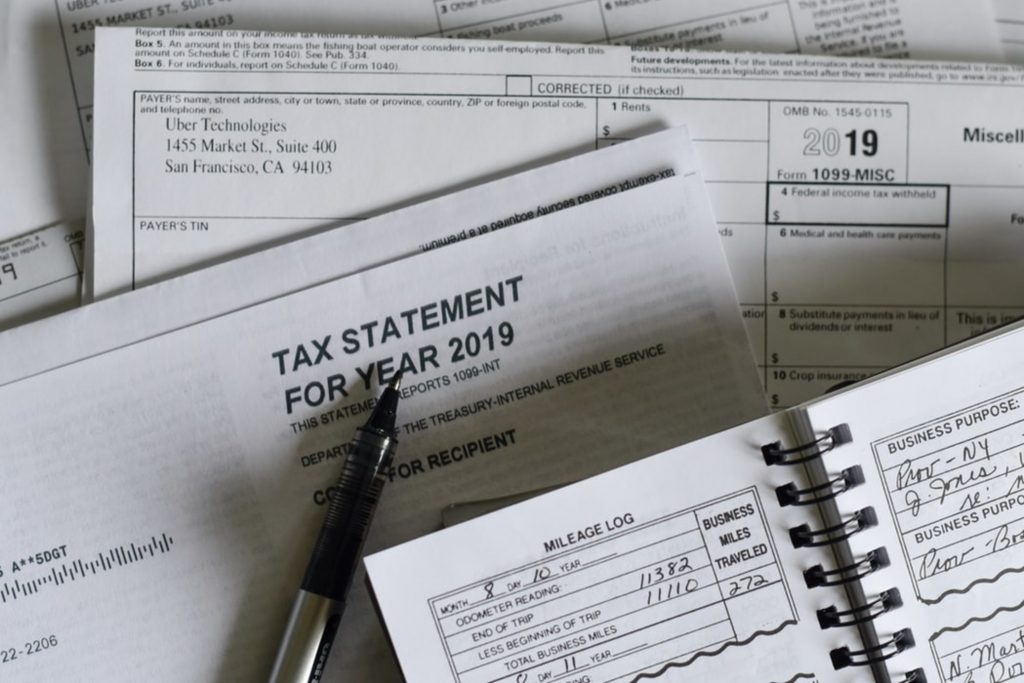

2. Tax implications

A corporation can be taxed as a wholly separate entity from the owners or choose to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code.

A major drawback of a C-corporation is its double-tax treatment, which means that the corporation’s income is taxed and then, any dispersals handed to shareholders are also taxed. By choosing an S election, a corporation’s income goes through the entity to its owners, who report that income on their tax returns akin to a sole proprietorship or partnership. Thus, an S-corporation abolishes double taxation.

LLCs can be taxed in four distinctive ways, so you should consult with an attorney and a CPA before deciding as to how your LLC would be taxed.

3. Expense of formation and administration

Tax advantages may not provide sufficient benefits to counterbalance other expenses of conducting business as a corporation. The high cost of record-keeping and documentation, and the costs linked to incorporation, as a huge reason that business owners elect to choose another option such as a sole proprietorship or partnership. Handling administrative requirements typically takes up a lot of your time and therefore, creates costs for the business.